FAQ: Implementation of SST for International Students

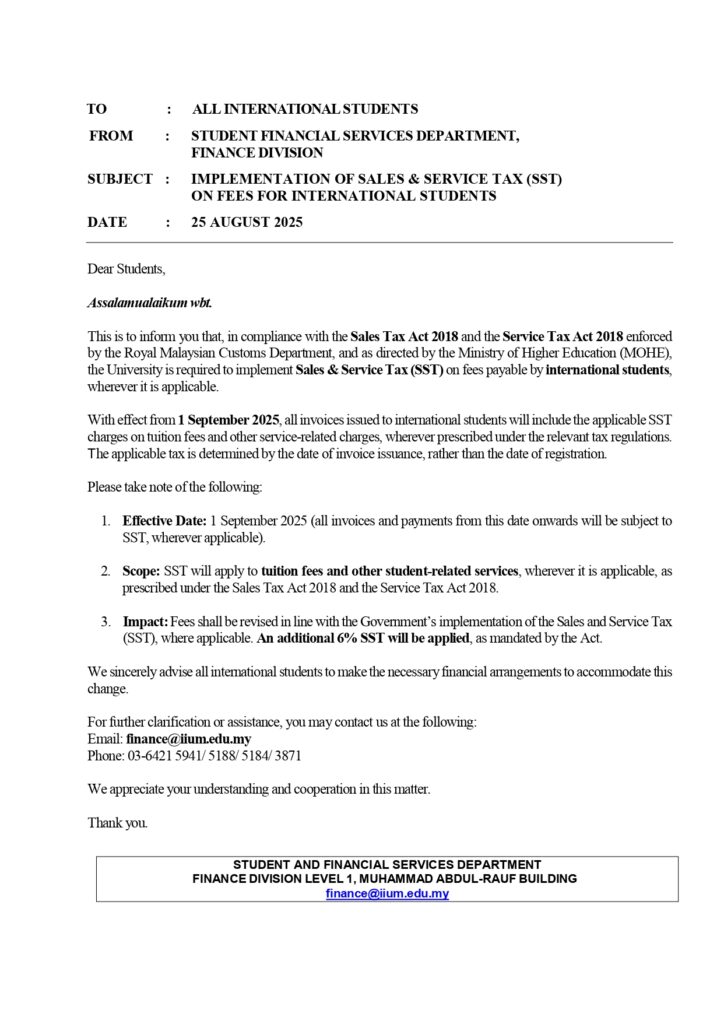

1. Why am I being charged SST 6%?

Sales and Service Tax (SST) is a statutory tax imposed under Malaysian regulations. The University is required to implement and collect SST in compliance with the applicable tax laws.2. Why is the SST reflected only now?

The SST charges were reflected after the completion of internal verification and system finalisation to ensure accurate processing and proper financial recording.3. When is SST applicable?

SST is applicable to relevant charges from September 2025 onwards. All applicable invoices issued from this period will include SST.4. Why is the SST shown separately in my Student Financial Statement?

The SST amount is displayed separately to ensure transparency and to allow students to clearly understand the breakdown of charges.5. Will there be any penalty if I am unable to pay immediately?

Students are advised to arrange payment at their earliest convenience. If you anticipate any difficulty in making payment, please contact the Student Finance Department for further assistance.6. Who should I contact for clarification?

For any clarification or further explanation, please contact the Student Finance Department at finance@iium.edu.my.7. Why was SST not included in my earlier offer letter?

The offer letter reflects the estimated fees at the time of issuance. As tax regulations may be updated or clarified from time to time, the University is required to comply with the latest applicable requirements, including the implementation of SST.