IIUM Staff Financing

Only IIUM staff under permanent and contract status are eligible. Temporary contract and part-time staff are not eligible. For more information, contact the Financing Department, Finance Division.

COMPUTER FINANCING

Who is eligible to apply for computer financing?

IIUM Staff serving under permanent and contract status only. Staff serving under temporary contract and part-time status are not eligible for consideration. You may liaise with our Financing Department, Finance division for further information.

What is meant by purchasing / the purchase of computers under computer financing?

Purchasing / The purchase of computers means the purchase of computers including their hardware and software or the purchase of hardware and software to enhance the computer at the time of purchase.

This financing amount can be used to purchase new computers which include personal computers, and laptops as well as the purchase of printers and scanners. The purchase of smartphones and tablets are also being allowed and considered part of the financing amount.

What are the basic qualifying requirements for an officer to apply for a computer financing?

- the monthly installment deduction amount does not exceed 1/3 of basic salary.

- the total deduction including deductions for computer financing does not exceed 60% of the total basic salary and monthly allowance

What is the maximum limit of eligibility for computer financing?

The maximum financing amount is RM5,000

How long is the allowable period for maximum repayment?

The allowable period for maximum repayment is 48 months.

What is the profit rate or percentage imposed on the approved financing amount?

University does not impose any profit according to the financing amount, only administrative cost amounting RM 50 will be imposed for every approved application regardless of financing amount and financing tenure.

Can an officer make a second computer financing application?

Yes, the officer is allowed to make a new computer financing once in every three (3) years. The new application can only be approved after three (3) years calculated from the date of the previous approval and provided the present financing facility has been settled.

What is the procedure for making an early settlement for the computer financing balance?

- Obtain confirmation of the financing balance through the balance inquiry process for the lump sum settlement with the Financing Department, Finance Division.

- Subsequently, the borrower will need to make full payment based on the verified balance and comply with the specified date period by direct bank-in / bank draft payable to “UIAM Operating Account”.

- -Furnish the original copy of bank-in slips or proof of payment for electronic transfer to the Financing Department, Finance Division.

VEHICLE FINANCING

Who is eligible to apply for vehicle financing?

IIUM Staff serving under permanent and contract status only. Staff serving under temporary contract and part-time status are not eligible for consideration.

What is the existing package or category under vehicle financing?

A) Financing Facility using University Fund

i. Motorcycle Financing

– apply to all qualified staff.

ii. Car Financing

– only applicable to international/foreign staff and subject to the contract period.

B) Subsidize Financing Schemes with Financial Institutions.

i. Car Financing

– apply to all Malaysian staff.

– the list of bank panels under the scheme: Bank Muamalat Malaysia Berhad, Bank Islam Malaysia Berhad, AmBank Islamic Berhad and Bank Kerjasama Rakyat Malaysia.

What are the basic qualifying requirements for an officer to apply for vehicle financing?

- The monthly instalment deduction amount does not exceed 1/3 of the basic salary.

- The total deduction including deductions for vehicle financing does not exceed 60% of the total basic salary and monthly allowance.

- The officer must have a basic salary of at least RM1,620 for a car purchase.

- Require 2 guarantors among IIUM staff for motorcycle purchase.

- Possess a valid driving license.

What is the maximum limit of eligibility for vehicle financing?

- The maximum financing amount is as follows:

- Purchase of Motorcycle up to the amount RM10,000.00

- Car Purchase is according to job position.

| Position | Financing Limit Amount |

| a) Special Grade (VK7 and above) | RM 70,000.00 |

| b) Professional & Management | RM 65,000.00 |

| c) Support Group | RM 55,000.00 |

How long is the allowable period for maximum repayment?

Type of Vehicle | Period |

a) New Car | Not exceeding 108 months |

b) Used Car | Not exceeding 96 months |

c) New Motorcycle | Not exceeding 60 months |

I have obtained financing approval from the panel bank for the Subsidize Financing Scheme with the Financial Institution, what should I do?

After securing the financing approval from the panel bank, you need to fill up the IIUM Financing form to enjoy the subsidy financing charges for the monthly instalment. You may liaise with our Financing Department, Finance division for further information.

How did the subsidy financing charges work under the Subsidize Financing Scheme with the Financial Institution?

The Financing Department, Finance Division will calculate the subsidy portion according to the staff eligibility and the University will pay part of the financing cost charges for the monthly repayment amount to the bank.

This means that the salary deduction for staff will be lower than the amount of the repayment stated in the bank offer letter. Next, the University will make the payment as per the amount stated in the bank offer letter.

Can an officer make a second vehicle financing application?

Yes, the officer is allowed to make a new vehicle financing once every five (5) years. The new application can only be approved after five (5) years calculated from the date of the previous approval and provided the present financing facility has been settled

What is the procedure for making an early settlement for the vehicle financing balance?

A) Financing Facility using University Fund

– Obtain confirmation of the financing balance through the balance inquiry process for the lump sum settlement with the Financing Department, Finance Division.

– Subsequently, the borrower will need to make full payment based on the verified balance and comply with the specified date period by direct bank-in / bank draft payable to “UIAM Operating Account”.

– Furnish the original copy of bank-in slips or proof of payment for electronic transfer tothe Financing Department, Finance Division.

B) Subsidize Financing Scheme with Financial Institution

– Staff need to liaise directly with the respective panel bank for the early settlement procedure.

HOUSING FINANCING

Who is eligible to apply for housing financing?

IIUM Staff serving under permanent status, has served for at least one year and has confirmed in service.

What is the existing package under housing financing?

Currently, the University offers a subsidized housing financing scheme with the Financial Institution. To facilitate the process of housing financing, IIUM has appointed four (4) panel financial institutions. The fund originates from the respective Financial Institution itself.

The list of 4-panel banks is as follows:

a) Bank Muamalat Malaysia Berhad

b) Bank Islam Malaysia Berhad

c) AmBank Islamic Berhad

d) Bank Kerjasama Rakyat Malaysia.

What is the financing rate under the subsidized housing financing scheme?

The financing rate is 4% per annum based on reducing balance. IIUM will subsidize the profit rate for portions exceeding / beyond 4%. For example, if the bank approves the rate at 4.90%, thus IIUM will subsidize the rate of 0.90%

What are the basic qualifying requirements for an officer to apply for housing financing?

i. The monthly instalment repayment amount does not exceed 60% of the total basic salary and monthly allowance.

ii. The total deduction in the payslip including deductions for housing financing does not exceed 80% of the total basic salary and monthly allowance.

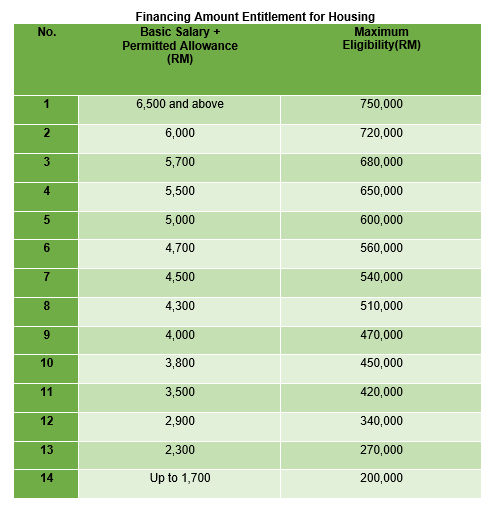

What is the maximum limit of eligibility for housing financing?

The range amount of approval is as follows:

I have obtained financing approval from the panel bank for the Subsidize Financing Scheme with the Financial Institution, what should I do?

After securing the financing approval from the panel bank, you need to fill up the IIUM Financing form to enjoy the subsidy financing charges for the monthly instalment. You may liaise with our Financing Department, Finance division for further information.

How did the subsidy financing charges work under the Subsidized Financing Scheme with the Financial Institution?

The Financing Department, Finance Division will calculate the subsidy portion according to the staff eligibility and the University will pay part of the financing cost charges for the monthly repayment amount to the bank.

This means that the salary deduction for staff will be lower than the amount of repayment stated in the bank offer letter. Next, the University will make the payment as per the amount stated in the bank offer letter.

Can an officer make a second housing financing application?

Yes, the officer is allowed to make two times facility / application over the service period. The new application can only be approved provided the first financing facility has been settled.

What is the maximum repayment period under subsidize housing financing scheme?

Category of Application | Maximum Years |

a) 1st Financing Facility

| 35 years or up to retirement age whichever is earlier |

b) 2nd Financing Facility

| 30 years or up to retirement age whichever is earlier |

I just realized, the approval amount and repayment period approved by the panel bank is beyond my entitlement that specified in IIUM eligibility and conditions. Does it mean my application will be rejected by the Finance Division?

Your application will not be rejected. However, the finance division will calculate the subsidy portion up to the maximum entitlement only.

University subsidizes the term charges imposed by financial institutions over and above the rate of 4% for amounts up to the maximum eligibility. Any amount above the eligibility will be charged at the bank rate.

If the financing repayment period is more than the eligible period (35 years), the subsidy will only be applicable up to the eligible period. Staff is responsible for the full rate after the eligible period ends.

My current entitlement for financing amount is RM 750,000 and 10 years ago I already utilized my first house facility with the financing amount RM 250,000. Does it mean my 2nd application entitlement will be RM 750,000?

No. Your entitlement will be the difference between “current entitlement” and “1st Financing amount approval”. In your situation, you are now entitled to up to RM 500,000 for 2nd application approval.

The bank officer advised me to submit a financing application through a joint name with my husband but he is not IIUM staff, can I apply for the subsidy scheme in this situation?

Yes, you can apply the subsidy scheme under joint name financing circumstances provided the repayment of the instalment shall be made by way of IIUM salary deduction.

Any inqury contact us at below

03 – 6421 3873

03 – 6421 3870

03 – 6421 3187