Student Announcement

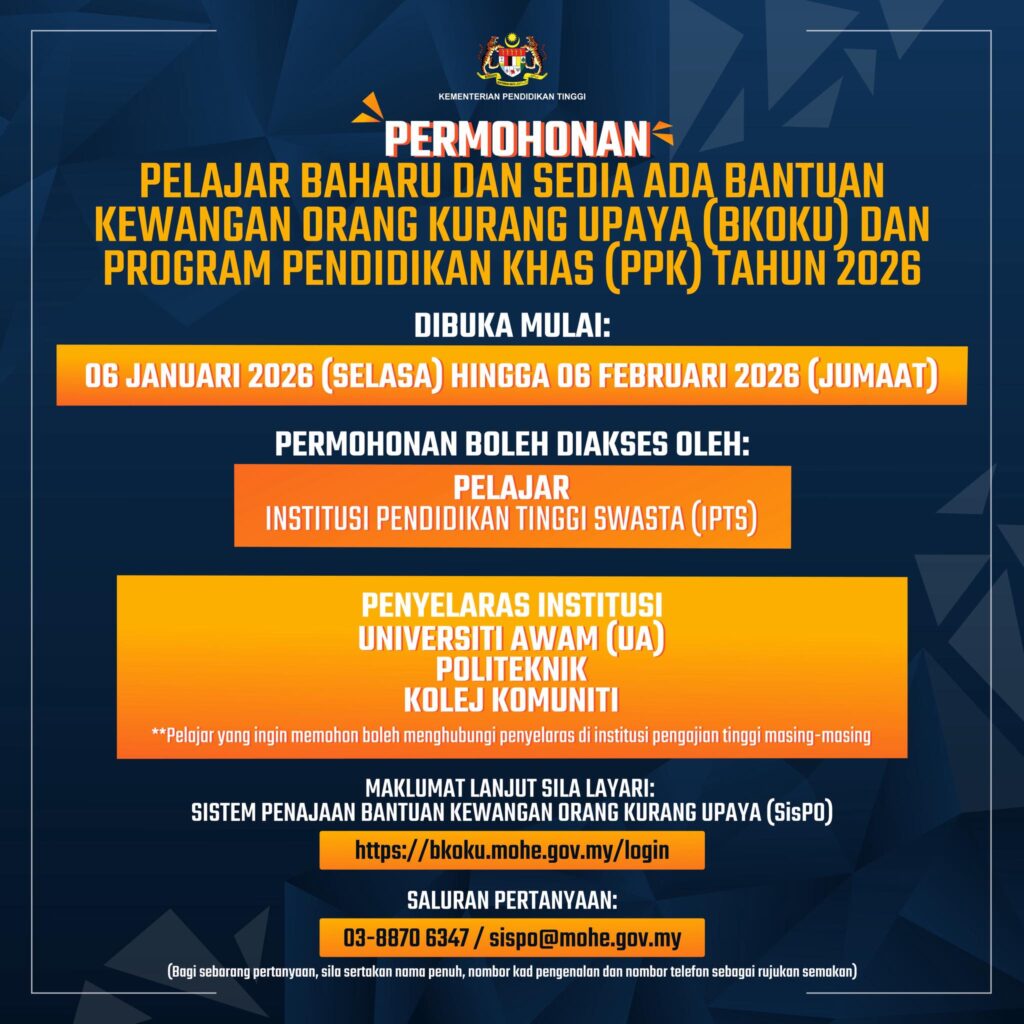

PERMOHONAN BANTUAN KEWANGAN ORANG KURANG UPAYA (BK-OKU) DAN PROGRAM PENDIDIKAN KHAS (PPK) TAHUN 2026

Untuk makluman : Permohonan BKOKU dan PPK dibuka mulai 6 Januari (Selasa) 2026 sehingga 6 Februari 2026 (Jumaat). Untuk maklumat lanjut, sila layari https://bkoku.mohe.gov.my/login atau boleh ke Disability Services Unit (IIUM) Sebarang pertanyaan, sila hubungi hotline BKOKU di talian 03-8870 6347 atau e-mel ke sispo@mohe.gov.my Terima kasih.

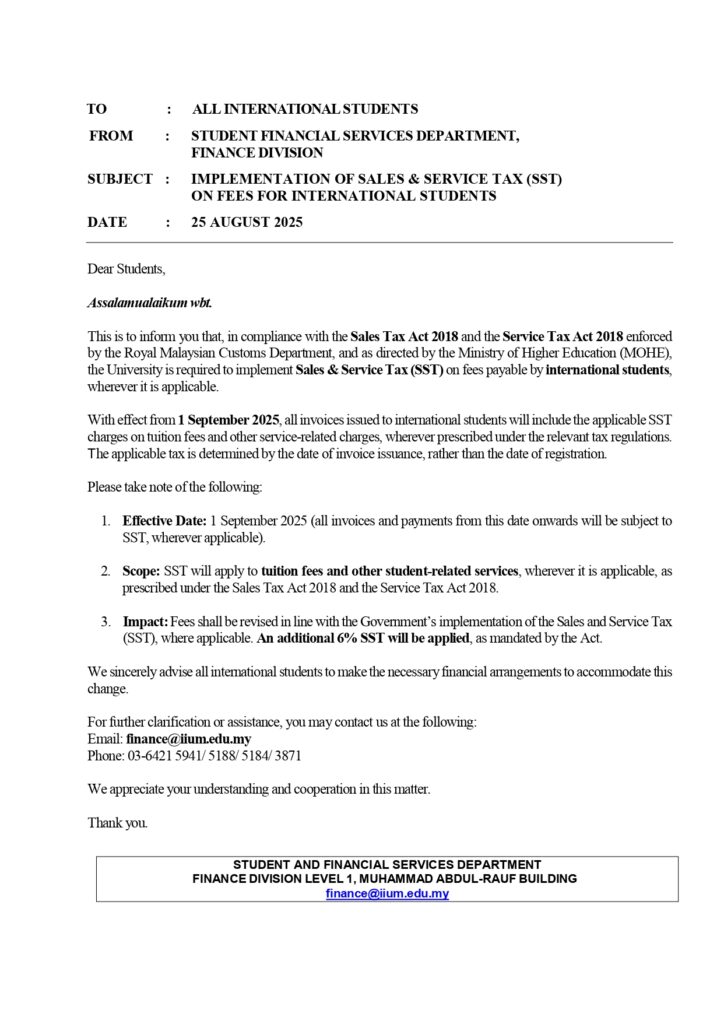

IMPLEMENTATION OF SALES & SERVICE TAX (SST)ON FEES FOR INTERNATIONAL STUDENTS

FAQ: Implementation of SST for International Students 1. Why am I being charged SST 6%?Sales and Service Tax (SST) is a statutory tax imposed under Malaysian regulations. The University is required to implement and collect SST in compliance with the applicable tax laws. 2. Why is the SST reflected only now?The SST charges were reflected after …

IMPLEMENTATION OF SALES & SERVICE TAX (SST)ON FEES FOR INTERNATIONAL STUDENTS Read More »